In today’s fast-evolving financial landscape, delivering seamless and consistent communication is essential for credit unions to stay competitive and meet member expectations. According to a recent McKinsey study, nearly 90% of consumers demand a consistent experience across all communication channels, but less than a quarter of financial institutions are truly delivering on this expectation. For international credit unions, the adoption of omni-channel communication solutions like Zoom and NICE CXone offers a unique opportunity to enhance member engagement, streamline workflows, and drive long-term growth. As the Credit Union Conference approaches, it’s important to explore how omni-channel communication, powered by Zoom and NICE CXone, is shaping the future of credit union contact centers.

Omnichannel communication ensures that credit union members can experience a seamless, unified interaction across all touchpoints. Whether members are accessing their accounts through a mobile app, calling customer service, or visiting a branch, they can also resolve queries through web chats, SMS, or even social media. This holistic approach guarantees a consistent and connected experience, no matter the communication channel. NICE CXone and Zoom solutions allow credit unions to maintain consistent, efficient communication. These solutions not only enhance member satisfaction but also drive operational efficiency in the credit union contact center.

Consider a scenario where a member initiates a loan inquiry through a mobile app, follows up through a Zoom consultation, and completes the process in person at a branch. Without an omni-channel system like NICE CXone, these interactions might feel disconnected, frustrating the member and causing potential service delays. However, with a proper NICE implementation, credit unions can unify these touchpoints, providing a smooth transition from one communication platform to another.

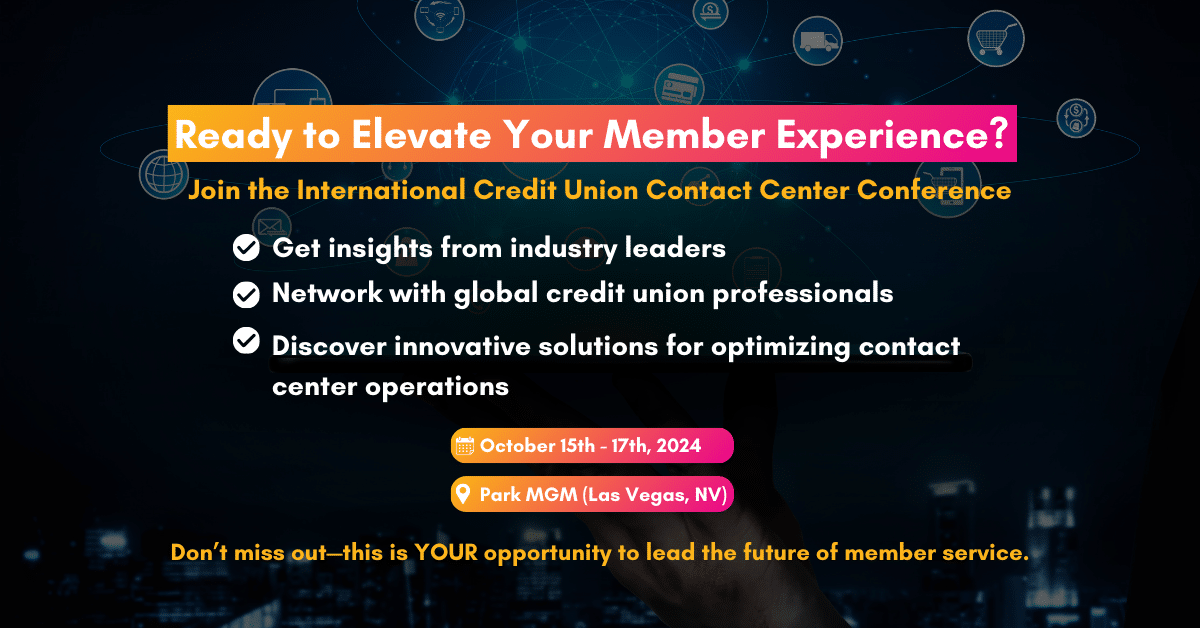

The Credit Union Conference will highlight how integrating tools like Zoom customization into contact centers helps credit unions deliver a consistent, personalized experience across all member interactions. This not only strengthens relationships but also positions credit unions for sustainable growth in a competitive market. As the digital transformation of financial services accelerates, NICE support becomes indispensable in enabling credit unions to stay ahead of evolving member expectations.

Today’s credit union members expect much more than basic service. They desire personalized, streamlined, and frictionless interactions across all communication channels. According to a 2022 Salesforce study, 76% of customers expect consistent service across all departments, but only 29% of financial institutions can meet this standard. This gap is particularly apparent in credit union contact centers, where seamless interactions can make or break member loyalty.

For international credit unions, the need for omni-channel communication solutions like Zoom and NICE CXone is increasingly urgent. Members no longer want to repeat information or experience disconnected service when switching from one platform to another. They expect a full understanding of their needs, whether they’re engaging through a Zoom consultation or contacting customer support.

Personalization has also become a critical element in communication. With tools like Zoom Contact Center and NICE CXone, credit unions can provide real-time, tailored service to members based on their preferences and past interactions. This allows for more meaningful engagements, which can directly contribute to higher retention rates and increased member satisfaction.

At the Credit Union Conference, experts will discuss how technologies can bridge the gap between member expectations and current service offerings. Implementing these technologies not only improves the credit union contact center experience but also strengthens member relationships, driving long-term loyalty and trust.

The foundation of any successful omni-channel communication strategy lies in the technology that powers it. For credit unions, leveraging the right tools such as Zoom and NICE CXone is essential to provide the consistent, personalized experiences members now demand.

Zoom and NICE CXone help credit unions streamline communication across all touchpoints, ensuring that member interactions are always seamless and connected. For instance, Zoom automation can handle repetitive tasks, allowing members to receive instant responses for common queries, while freeing up staff for more complex interactions. At the same time, NICE implementation ensures that all member data is centrally managed, allowing credit union staff to have a full view of each member’s journey and provide better support.

The integration of Zoom and NICE CXone enables credit unions to deliver real-time support, manage multiple communication channels effectively, and personalize services based on member needs. By adopting this technology, credit union contact centers can significantly improve operational efficiency and enhance the overall member experience.

At the Credit Union Conference, credit union leaders will have the opportunity to learn how to maximize the potential of NICE CXone and Zoom configuration to drive omni-channel success. The event will showcase real-world examples of how these tools have been successfully implemented to create more efficient workflows and improved member engagement.

As the financial services landscape continues to evolve, credit unions must stay ahead by adopting omni-channel communication strategies. The Credit Union Conference offers an unparalleled opportunity for credit union leaders to explore how Zoom automation and NICE automation are transforming member experiences and shaping the future of credit union contact centers.

At the conference, attendees will learn how leading credit unions have successfully implemented omni-channel strategies to drive member satisfaction, loyalty, and growth. The event will cover everything from the latest communication technologies to member experience trends, all tailored to the unique needs of credit unions. Additionally, the conference will showcase B-TRNSFRMD, a platform specifically designed to help credit unions integrate omni-channel communication effortlessly. With its user-friendly features and powerful integration capabilities, B-TRNSFRMD enables credit unions to provide top-tier service and meet the rising demands of their members.

Don’t miss out on the opportunity to network with fellow credit union leaders and learn from the best in the industry. The Credit Union Conference is your gateway to mastering omni-channel communication and setting your credit union on the path to success. With the help of Zoom and NICE CXone, your credit union can deliver the exceptional member experiences needed to thrive in today’s competitive market.

In an increasingly digital world, omni-channel communication has become essential for credit unions looking to maintain member loyalty and stay competitive. By integrating solutions like Zoom and NICE CXone, credit unions can ensure that member interactions are seamless, personalized, and efficient across all platforms.

The Credit Union Conference provides a unique opportunity to learn how to implement omni-channel strategies that will not only enhance member satisfaction but also boost operational efficiency and growth. Ready to take your credit union to the next level? Register now for the Credit Union Conference and discover how B-TRNSFRMD can help you deliver exceptional member experiences through integrated communication solutions. Don’t miss this opportunity to transform your credit union’s communication strategy and stay ahead of the competition!

To explore how enhancing employee engagement can drive your credit union's success, read our blog Is Employee Engagement Key to Your Credit Union’s Success? Stay ahead in the evolving landscape by unlocking the full potential of your team.